I have been manic-coding 40 of the last 48 hours. I contemplated writing yesterday’s letter and was so far in another world that I blinked and realised the day was gone. I am working on some interesting ideas, so I will be pushing hard on that front over the next week or 3 and share with you shortly.

S2N Spotlight

The US released yesterday their latest fiscal budget deficit for the 30 September 2024 fiscal year. It came in at another massive $1.8 trillion deficit. I was curious to see whether the US Dollar was still the world’s reserve currency given these continuous deficits. The IMF’s most recent FX Reserves report came out last week, so this is what I discovered.

Short answer: yes, it is still the world’s reserve currency by a long way. I have kept it separate from the other countries for dramatic effect 😎 to show how it has dropped from above 65% in 2016 to 58%.

As an Aussie, it is good to see us boxing above our weight again. We are a country with less than 30 million people and lots of kangaroos.

It is still hard to see the clear beneficiaries at the expense of the US Dollar. I am not an expert in foreign reserves. I did a little bit more investigation out of curiosity and picked up the fact that the amount of unallocated reserves has dropped quite dramatically. This section represents the part of a country’s balance sheet their governments are unwilling to share with the IMF. Not sure what happened between 2016 and 2018. Governments have become so transparent, it’s like they’re running on incognito mode… but forgot to hide their browser history! (I think I need more sleep).

For the sake of completion, here is a 50-year chart of the US Dollar.

S2N Observations

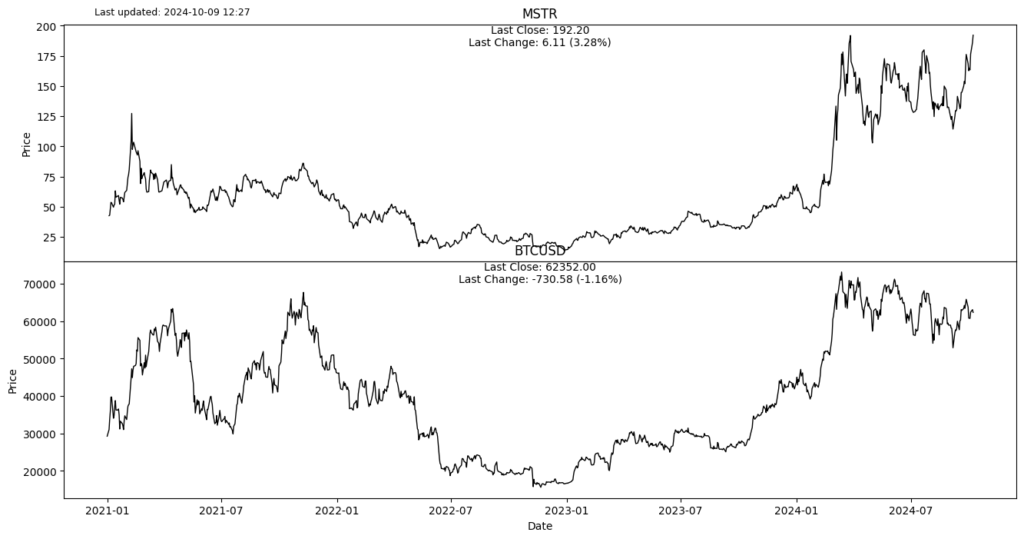

Michael Saylor’s MicroStrategy is making new highs while Bitcoin trails. I keep forgetting this guy sells software and owns bitcoin. I default to thinking he sells underwear as he has to have the biggest pair ⚽⚽ in the business. Excuse my description.

Let’s get to the serious stuff.

I did a quick analysis to see how many times the Hang Seng has dropped 5 standard deviations from its mean in the last 50 years. Allow me to provide some context. According to a normal distribution, a 5 sigma event should happen 1 in 3.48 million times. There are 12,600 trading days in 50 years. According to my statistics, there have been 12 five-sigma events in the past 50 years. My chart shows the last 2 years only for beauty reasons. It has been 5,825 days since the last such event. You can see how the previous 12 times performed.

So have I given up on my trade long China short US stocks? Hell no. If investing was easy, everyone would be a winner. To add a little wrinkle, the Chinese stock market rallied after the week holiday. I have chosen to express my view via the Hang Seng as there is likely to be less manipulation.

Here is the view I am watching.

Performance Review

For those who are new to the letter, the shading is Z-Score adjusted so that only moves bigger than usual for the symbol are highlighted.

Chart Gallery